Oxford Properties 125 Summer Street is new home for Analog Devices innovation lab. Citing ease-of-access to public transportation as a key influencer in its decision to move to 125 Summer Street in Boston’s Financial District.

Credit: Bizjournals

From the BBJ:

Analog Devices Inc. is more than tripling the size of its startup incubator and emerging technologies lab in a move from Cambridge to downtown Boston — an expansion that will allow the Norwood-based multinational semiconductor company to hire an additional 80 to 140 workers for its emerging-technology group.

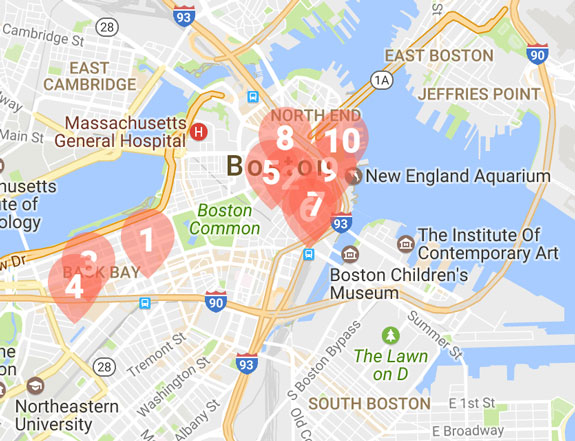

The [125 Summer St.] office provided the best mix of easy access to both the MBTA Red Line — a must for a company with roots at MIT, and an employee base that lives in Somerville and Cambridge — as well as what O’Doherty called the burgeoning startup culture of both downtown and the Seaport.