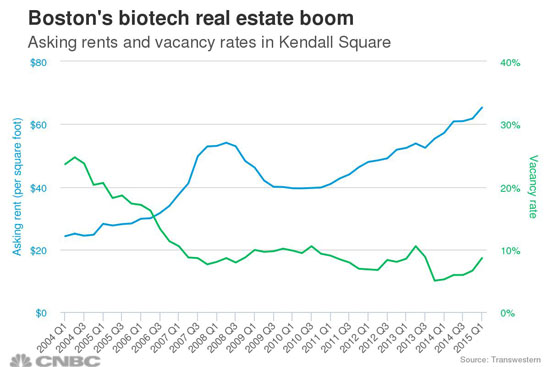

Great Boston leads the nation with the most expensive lab space.

According to the BBJ, quoting a Sciences Outlook report by brokerage JLL, “Boston and Cambridge are by far the most expensive life sciences markets to rent lab space in the United States…Greater Boston’s life sciences rental rates have climbed 7.4 percent this year to reach an average rate of $47.40 per square foot. In Cambridge specifically, the average lab rent is $51.60 per square foot, the report said. The report also said tenants are currently on the hunt for around 1.3 million square feet of space in the city.”

You can read the full article on the Boston Business Journal’s website.