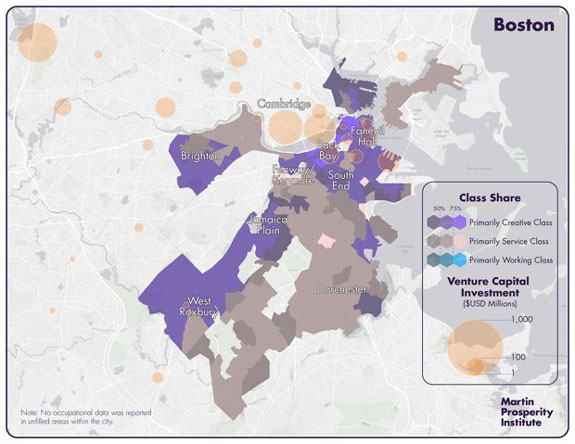

Where do venture-backed companies focus when coming to the 617 area code? Unsurprisingly, the list focuses on the city core with areas like the Seaport, Financial District, Back Bay, Kendall Square and some clustered at the 90/95 interchange.

Credit: City Lab

Here’s a national perspective from City Lab:

While many large, high-tech companies like Facebook, Google, Apple, and Microsoft have their main campuses in suburban areas, cities and urban areas house the majority of venture capital–backed startups. My own research estimates that 55 percent of all venture capital investment now flows to urban neighborhoods. In the Bay Area and Boston–Cambridge, more than 60 percent of venture capital investment gravitates to these neighborhoods.

Additional information is available on CityLab’s website.