Category Archives: Boston Commercial Real Estate

0 AURA Reaps $23.9M for Brookline Rentals; Boston Realty Advisors Brokers Luxury Deal

AURA Reaps $23.9M for Brookline Rentals; Boston Realty Advisors Brokers Luxury Deal

May 11, 2021 — By Joe Clements

BROOKLINE — Seemed like a good idea from inception, and developer AURA Property’s vision five years ago has been validated via its sale of a Coolidge Corner luxury mixed-use building to another homegrown group for an impressive $23.9 million through exclusive agent Boston Realty Advisors. The project has 25 apartments mostly in a five-story building with a three-unit block of fully occupied ground-floor retail along with the upscale housing which has fared well in the face of a lingering pandemic which apparently has had little negative influence on 420 Harvard St.’s popularity.

“It was a very, very competitive process,” BRA Capital Markets member Kevin Benzinger recounts of the exclusive assignment which had founding principal Jason S. Weissman leading the charge joined by Partner Nicholas M. Herz and Associate Director Andrew B. Herald.

BRA’s campaign yielded over 100 confidentiality agreement requests manifesting dozens of tours and culminating in a spirited stretch run where local and regional investors were reportedly pitted against domestic institutional capital and players hailing from Europe and throughout the Pacific Rim.

“A lot of eyes were on this one,” Benzinger confirms in declining to identify the winning bidder or multiple also-rans said to have been close on the heels of victor 420 Harvard FMS LLC, its manager identified in Middlesex South Registry of Deeds and state corporate filings as Hamid Shirkhan, the president of Fluid Management Solutions of Billerica.

Market watchers tracking the trade maintain it is the back end of a 1031 Exchange following January’s trade of a surplus FMS industrial property in Watertown at 580 Pleasant St. dispatched to Griffith Properties and DRA Advisors, a $21.5 million sale previously unveiled by Real Reporter in January. “Right,” one source replies when acknowledging the 1031 link to each sale.

DBA 420 Harvard Street Associates, AURA Properties is led by Victor Sheen, registry records show. Benzinger praises BRA’s client for delivering a product using best-in-class design and materials at a “killer” location that has global recognition. “Brookline’s name carries far,” relays Benzinger, his firm active in the metro Boston multifamily scene familiar with the international allure of Beacon Hill, Harvard Square and Newbury Street, and he explains Brookline has similarly widespread appeal as a residential address.

If so, Coolidge Corner would seem to be the community’s centerpiece, and Benzinger says it was key to delivering over $800,000 each for the housing component, to him a record price for Boston rentals even though there is a 20 percent affordability requirement at 420 Harvard St. as mandated by the special state statute which empowered the developer to circumvent local zoning in the name of promoting affordable housing, that well-known legislation commonly known as Chapter 40B.

Even with that as a strong bargaining chip, AURA had to endure a challenging approval process where nearby residents and town officials concerned over scale ultimately got the plan down from 36 rentals to the 25, of which 23 are in the main building comprising 42,000 sf and another two are an adaptive re-use of 49 Coolidge St. Its 25 apartments range from studios to three-bedroom layouts and The Calvin, as it is branded, also features underground parking for two dozen vehicles and an open-space patio component welcomed in the thickly settled neighborhood.

Benzinger also credits AURA for creating an assemblage that appeared impervious to the Covid-19 calamity, its resilience seen as a combination of urban Boston’s fundamentally strong multifamily sector and being an opportunity totally finished and minus trepidations investors might have for permitted properties at a time when construction costs are rising capriciously and copiously. “Having the construction completed was a major reason for the exceptional response,” he says.

The Calvin also drew rave reviews for its “thoughtful” design as conceived by architect EMBARC Studio deemed functionally and fashionably astute through elements including bicycle storage, a stocked “amenity center’ and the functional ground floor retail anchored by acclaimed baker and cafe Tatte.

The market-rate apartments are reportedly performing admirably with rents pegged in the $5-per-sf realm highlighted by two penthouse units and all apartments featuring quartz countertops, oversized windows providing abundant natural light and first-rate appliances as well as central HVAC and in-unit washers and dryers.

Besides the hefty apartment revenue, cash-flowing retail provides The Calvin’s new steward additional resources, notes Benzinger, and financing was available by assuming a mortgage AURA had secured through the Massachusetts Housing Partnership. The loan’s remaining principal at the time of closing stood at $14.5 million, registry records indicate.

Read article on The Real Reporter.

0 CRES Stats Report | Week Ending April 2nd

CRES Stats Report | Week Ending April 2nd

- Keeping with recent history, 34 spaces hit the market as available in the subject area in the last 7 days, equating to ~207,000 SF, which is substantially lower than recent weekly additions;

- 22 spaces (over 1,000 SF) came off the market equating to ~136,000 SF, consistent with recent history;

- Amazingly, we crested to a new high of 17.2MM SF of Availability in the downtown during the last 7 days.

0 The Transparency of Investing in Brick and Mortar Real Estate

The private commercial real estate investment market will continue to grow.

By Jason S. Weissman | Wealth Management | March 22, 2021

One of the core truths in value investing is the need to understand the risks involved, and that sometimes the risks are far greater than the rewards. Today, however, investors in the public equity markets are blindly making bets on vast future growth without realizing that the rewards must meet the risks. Are those future profits really going to materialize?

As an example, there is much talk today about Tesla, a company characterized by Seth Klarman—one of the world’s foremost value investors and the founder of hedge fund Baupost Group—as “barely profitable,” yet its shares had soared “seemingly beyond all reason.” As reported by the Financial Times, in a private letter to investors in his fund, Klarman placed considerable blame on current central bank policies and government stimulus that convinced investors that risk “has simply vanished”, and that this has left the public equities market unable to fulfil its role as a price discovery mechanism.

Compare this irrational exuberance with the rigorous, and increasingly data-based, underwriting standards for investing in the hard commercial real estate asset class. One of the greatest attractions of investing in brick and mortar real estate is its transparency.

Fact-based underwriting standards and metrics applied to investing in brick and mortar real estate have been in place for decades. Lenders study market vacancy rates and new product coming to market. What are the historical rents, historical operating expenses, NOI? What will the mortgage be? These questions are part of authentic underwriting and how to do a deal.

In contrast, where is the data to show why Tesla should be trading at a 1,200 price-to-earnings ratio? Perhaps this has something to do with space travel? I am no expert in public equities, but no one seems to have an explanation why, in the middle of a pandemic, the S&P 500 is at an all-time high. Furthermore and regarding publicly traded tech companies, how can anyone predict cash flow levels 5 to 10 years in the future? Some of the safest brick and mortar real estate investments can be bought in the 4% cap rate range. This is equivalent to about a 20 price-to-earnings ratio. While the growth potential may not be similar to Tesla, there isn’t nearly as much downside.

With that, when an investor acquires a multifamily property, that said investor will proceed well-equipped with a wealth of data to evaluate downside and risk. I also believe that this is why there is no bubble in commercial real estate. The market has specific guidelines to protect against bubbles. Lenders are no longer offering financing at 100% loan-to-value. Today, it is 65 percent to 70 percent LTV. Banks are looking more closely at the sponsors and how much liquidity they have. They are looking at rent comparables and competing inventories.

With hard assets, the investor has more control. The investor sees real numbers and analyses to make evaluations. Even better, it has gotten easier to purchase and sell real estate over the past 20 to 30 years, because there is more transparency and efficiencies in the real estate markets. When hard assets trade, they generate valuable data. Risk meets reward.

Today, cap rates are depressed, and asset values of commercial real estate are inflated due to the cheap cost of capital. These facts notwithstanding, many real estate asset classes are underwritten with very stringent guidelines. Borrowers are putting a lot of capital into deals and the market is efficiently performing. I believe that hard real estate assets are priced fully, but not overpriced.

Many of my colleagues and I are predicting that approximately $200 billion of investment capital will come off the sidelines this year as investors re-enter the market after waiting out the uncertainty of 2020. Accordingly, we expect commercial real estate investment to rise by 50 percent in 2021’s second half.

To be sure, there are areas of risk. How will people travel, and how will people work in the future? With that said and when you look at the actual deals, the data reveals opportunities that are under-writable. Housing, triple-net retail, industrial and logistics are true to form underwriting situations. These are assets that can be underwritten for investors and offer more predictability. If you are looking for a rational market, look no further than the private commercial real estate market.

There are ways to invest in commercial real estate today that do not require the investor to make major bets on how people will work, travel, and live in the future. This includes hard assets that have undergone stress tests over the past eight months.

For example, an investor does not have to make a major bet on New York City’s economic recovery to buy into local workforce housing in Brooklyn or Queens. A 200-unit multifamily property will generate data to enable the investor to underwrite a cash flow. This investor is not seeking an opportunity to back a luxury resort development in Hawaii. In other words, you will not be required to predict the future to do well. Available data makes the situation transparent.

In short, there is no bubble in the private, hard-asset commercial real estate market. Stringent and rigorous underwriting guidelines, based on data, removes the need to predict the future. Properties are being priced efficiently. You do not need to have faith, but you do need to underwrite according to the wealth of data available to you. Because of the transparency that data provides, money is flowing into brick and mortar.

Jason S. Weissman is founder and senior partner with Boston Realty Advisors.

0 Betting on Urban Multifamily Real Estate

With the new focus on suburbia, what will come of the urban multifamily investment market? Jason Weissman of Boston Realty Advisors explains.

By Jason S. Weissman | Multifamily-Housing News | March 19, 2021

A multitude of investors and investment groups have been routinely upping their ante to acquire hard real estate assets year-over-year. This diverse group includes a tapestry of family offices, hedge funds, institutional investors, high net worth individuals, wealth advisory firms and foreign equity, all of whom share a common goal—a need to put their money to work.

According to EY’s 2020 Global Alternative Fund Survey and following a multiyear trend, allocations to real estate increased to 26 percent from 23 percent the prior year.

The real estate industry in the U.S. is estimated to be worth more than $18 trillion and represents 13 percent of the GDP. Real estate investment opportunities include a large swath of assets to select from. One of the largest and most active segments of the industry is multifamily real estate in urban markets—specifically gateway cities throughout the U.S.

Historically, the urban multifamily sector has been one of the most secure and steady real estate investments, even during the Great Recession. For nearly 50 years, the global trend toward urbanization has been in vogue. People moved to cities in droves. The vital investment ingredients of high occupancy rates and consistent cash flow with little distress has made investing in urban multifamily a steady bet.

For the first time in decades, this sure bet on urban multifamily is up for debate. Since the start of the pandemic, investor appetite has augmented. As a result of most employees working from home, the appeal for urban multifamily has transitioned to suburban multifamily and suburban single-family rentals. Consequently, publicly traded single-family homebuilders, such as Toll Brothers and Pulte, are trading at all-time highs. Public REITs, who have exposure to urban multifamily, have been some of the weakest performers in the last 12 months.

Amongst many other byproducts of this pandemic, COVID-19 generated economic volatility and market unpredictability. With the new focus on suburbia, what is to come of the urban multifamily investment market?

Optimistic investors acquiring real estate today appreciate the required long-term investment horizon to maximize net operating income. Conservative investors are taking the long view. The good news is mutually shared, as optimists and conservatives alike are all betting on a recovery—with slightly different timelines.

Cautious and hesitant buyers have realigned their conventional underwriting criteria to “risk-off,” driven by their prediction of a rebound within the next four to five years. In the same supply-constrained gateway cities, optimistic, or “risk-on” investors are betting that gateway cities will rebound within the next two years.

History teaches us that cities always come back. Even when at their weakest, cities ultimately prove resilient and become enormous profit centers.

According to a Moody’s Analytics report, issued in the height of the pandemic, U.S. cities with collegiate centers and fast-growing tech hubs will be best positioned for a swift recovery.

In Boston, for example, the life science and technology sectors are tremendous assets for recovery. Recent commitments from companies such as Amazon and LogMeIn, as well as Sanofi and Moderna, all coupled with an abundance of intellectual capital, position Boston as one of the fastest cities to rebound in a post-COVID era.

The life science industry in Boston is expanding from traditional research and development to include biomanufacturing. This market increase has attracted an unprecedented investment for new life science development. In turn, this commercial growth will generate continued demand for multifamily housing throughout the city.

Further elevating support for betting on multifamily today is a recent report by NAREIT that indicated multifamily remained highly resilient in 2020, stating that rent deferrals and forbearances in multifamily properties were a small fraction compared to office and retail properties.

While the valuation of other asset types has tilted and other sectors have hit the investment pause button, cities such as Atlanta, Austin and Boston have urban multifamily properties trading at pre-COVID rates, with no pricing discounts.

Despite the realities of today, rent collection declines and falling occupancy rates—the urban multifamily market is alive and well. To validate this point, Freddie Mac, the nation’s multifamily housing finance leader, set a record in 2020 with $82.5 billion in multifamily loan purchases; most of those deals transacted in the latter half of the year and within gateway cities.

When we realize a full economic recovery, investors that are laser focused on urban multifamily today will be three steps ahead of the more conservative buyers still waiting on the sidelines. The collective investment community should play their cards today. Those that don’t will be kicking themselves in five years for holding their chips.

Jason S. Weissman was born in Boston and graduated from Curry College in three years and received an MBA from Babson College. Weissman founded Boston Realty Advisors in 2001. He launched the firm with multiple service lines under one roof—created leadership roles for multifamily, office, retail, hospitality and user housing—and became the largest, independent real estate services firm in New England. Weissman manages the investment sales and capital markets platform, with an owner-aligned philosophy. He is also the founder of The Broadway Co., a real estate investment company with more than 60 investment properties in North America and is an active member of numerous organizations including the International Council of Shopping Centers.

0 CRES STATS REPORT | WEEK ENDING MARCH 12th

CRES STATS REPORT | WEEK ENDING MARCH 12th

- 37 spaces hit the market as available in the subject area in the last 7 days, equating to ~255,000 SF, which is on the higher end of the curve of recent weekly additions;

- A paltry 16 spaces (over 1,000 SF) came off the market equating to ~113,000 SF (noting the characteristic churn of sublease spaces rotating to direct);

- UNFORTUNATELY, there was a large spike in availability and the current rate is now unbelievably knocking on the door of 17,000,000 SF (equating to 16.7MM SF);

- I’ll hopefully have better news next Thursday, stay tuned.

0 CRES Stats Report | Week Ending December 11

CRES Stats Report | Week Ending December 11

- 27 spaces hit the market as available in the subject area in the last 7 days, equating to 226,000 SF which is above the recent range;

- 21 spaces (over 1,000 SF) came off the market equating to 174,000 SF;

- The availability rate in Boston ticked up again slightly this week at 15,600,000 SF;

- The question now is when the availability rate will “top out”, with the effects of the COVID therapies versus leases ending (and those tenants renewing, downsizing, going virtual or relocating out of the downtown)?

0 CRES Stats Report | Week Ending December 4

CRES Stats Report | Week Ending December 4

- 21 spaces hit the market as available in the subject area in the last 7 days, equating to ~174,000 SF;

- Only 5 spaces (over 1,000 SF) came off the market equating to ~20,000 SF;

- Buildings reported this week to have “grown” including 125 High, Oliver Street Tower by 30,000 SF; 470 Atlantic by 9,500 SF; and 545 Boylston Street by a whopping 9% or 7,936 SF

- The availability rate in Boston ticked up this week closing in on 16mmSF equaling the recent highs at ~15,500,000 SF

0 Exclusive for Boston Realty Advisors A ‘Classic’ 60-Unit Rental in Harvard Square

By Joe Clements | The Real Reporter | November 18, 2020

CAMBRIDGE — Clover is never mentioned, but marketing materials from exclusive sales agent Boston Realty Advisors are singing the praises for Crimson Court in predicting the “generational” low-rise apartments steps from Harvard Square will be a 1960’s-era smash appealing to a vast audience of admirers.

“Crimson Court is an irreplaceable asset by every measurable standard,” BRA’s review proclaims of apartments held by the same clan who constructed the 60 low-rise units in 1965 and has “meticulously maintained” the holdings for all 55 of their leasehold seasons, BRA notes in a pitch suggesting the offering is much more than a one-hit wonder. That is literally true considering 375 Harvard St. is comprised of two buildings where two-thirds of the rentals are two-bedroom layouts mixed in with 10 studios and 10 one-bedrooms.

“We anticipate there will be a lot of interest in this,” BRA founding principal Jason S. Weissman tells Real Reporter in acknowledging the assignment launched Tuesday afternoon. By some accounts, Crimson Court could approach $425,000 per unit, which if achieved would land in the mid-$20 million range. Declining to discuss those unofficial estimates, Weissman says the level will be set through the bidding process but maintains institutional players will “definitely” be in the running along with private capital, setting up potential for a spirited battle among the suitors fueled by Crimson Court’s “Class-A location” between Harvard University and the Massachusetts Institute of Technology.

Besides being bookended by those two world-class schools attending on both the undergraduate and graduate levels, the rental constituency comes from young professionals drawn to a lineup of major employers in Cambridge’s Kendall Square and across the river in downtown Boston, both of which are accessible by the “Brain Train,” aka the MBTA Red Line subway which is a five-minute stroll from 375 Harvard St. For those attuned to money, money and other business perks, BRA has assembled a lineup showing dozens of Tier One Cambridge employers spanning the alphabet from Amazon, Biogen, Facebook, Google and Ironwood to Moderna, Novartis, Sanofi, Takeda and Yahoo.

There are also reams of direct public transit options spiriting tenants as far afield as Braintree, Waltham and booming Watertown, although BRA stresses Crimson Court has “a wealth of amenities” within walking distance from coffee houses, restaurants and takeout venues between Broadway and Massachusetts Avenue plus a panoply of entertainment and retail choices featuring global merchants and local boutiques. “Whether taking a stroll to a nearby park or enjoying the Charles River, the options are truly endless,” the BRA brochure further explains.

A leading urban multifamily operation with several record-breaking Cambridge deals under BRA’s belt over the past decade, Weissman expresses confidence Crimson Court will draw investor interest from around the corner and around the globe, and that instinct is already bearing fruit with BRA lining up tours of the asset almost immediately upon the exclusive assignment’s release Tuesday afternoon.

“We are super-excited about this one,” Weissman says of Crimson Court, adding BRA has a band of agents and specialists ready to assist bidders on demographics, rental metrics and other market trends. Managing Director and partner Nicholas M. Herz has debt and structured finance options available for interested investors, while Associate Directors Kevin Benzinger and Andrew Herald will dispatch street-level knowledge with support from Associates Daniel J. Dewing and Ryan McDonald plus Analyst David Harte.

Given the legacy nature of Crimson Court, Weissman says he is confident plenty of investors will pursue the asset and not only due to its steady performance over the past half-century and the “unprecedented opportunity” to buy such an infill location.

One tantalizing aspect, for example, are the 56 off-street parking spots located on the L-shaped site perched in a neighborhood where parking is severely restricted and regulated. That is one benefit of the asset’s longevity, according to BRA who is also promoting a value-add aspect available from upgrading the apartments and moving rents towards modern market averages.

“There are a lot of things to love about this property,” concurs Weissman who even sees a silver lining in the Covid-19 situation that appears in some analysis to indicate renters—and by extension, investors—have a perceived preference for more modest rental options size-wise compared to the high-rise residential towers that have been cropping up in metropolitan Boston this past decade. “The timing is right for this,” observes Weissman.

Crimson Court Apartments is held under the entity Audubon Road Associates CCSPE. The buildings are sited on a 32,325 sf parcel acquired by the family ownership in July 1963 just prior to their construction.

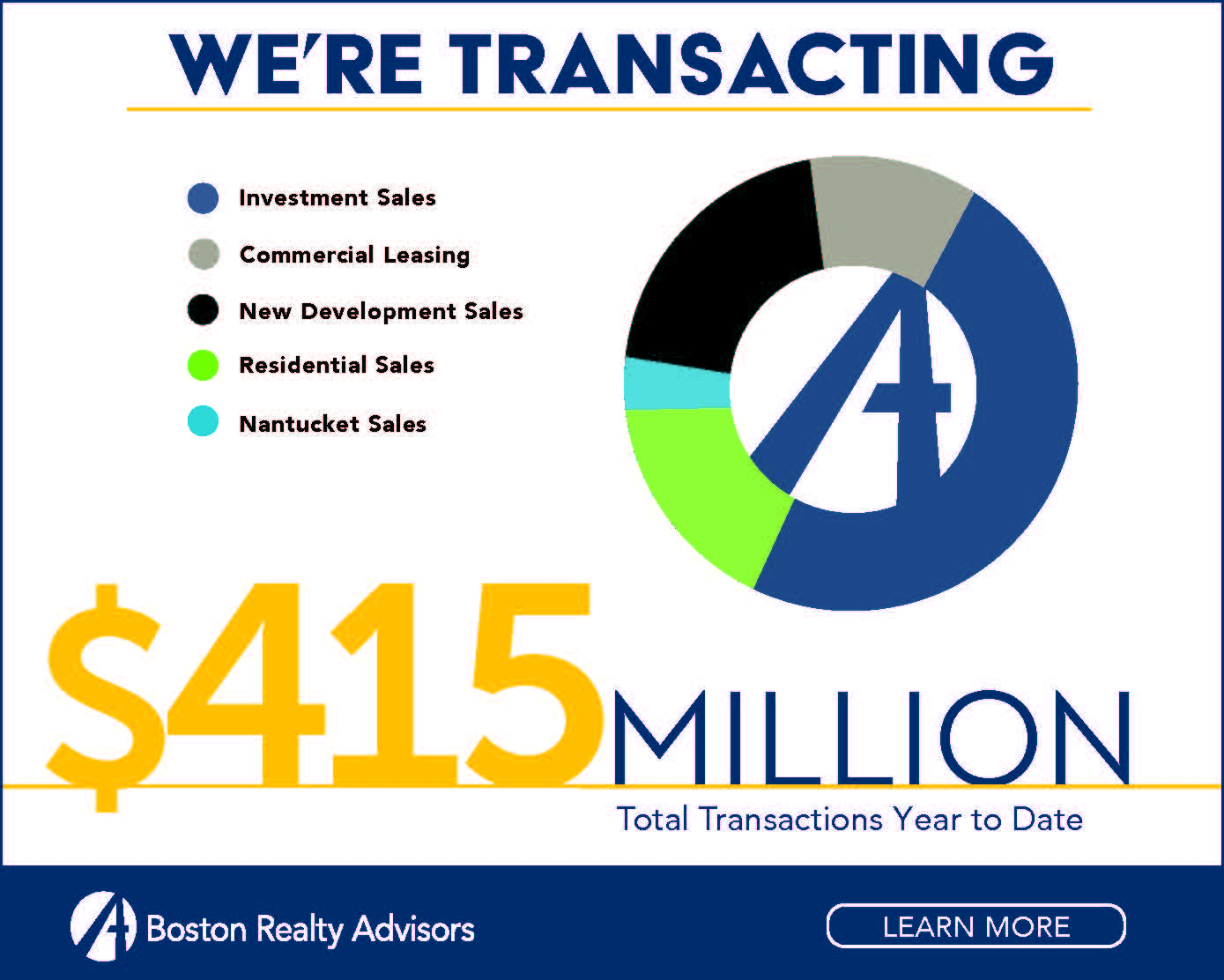

0 BRA Is A Market Leader With Over $415M Inked YTD

BRA IS TRANSACTING IN A LIVE-WORK-PLAY ENVIRONMENT.

SELLING HOMES. LEASING COMMERCIAL SPACE. BROKERING INVESTMENT SALES.

Learn more HERE.