So you have just been funded and you are in the hunt for the perfect office to grow the team. Have a look at the new digs for Facebook in Cambridge for some ideas.

Ryan Mack, the site lead for Facebook Boston notes in a blog post, “we look forward to hosting some of these events at the Facebook office, where we have a newly expanded space to support our growing engineering team. In the coming year we’ll continue hiring experienced engineers for our Boston team to work on data infrastructure, core systems services, location, and language runtimes, as well as new grads.”

You can also check out photos of Facebook’s office space in Cambridge on its site.

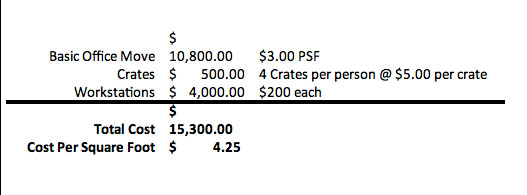

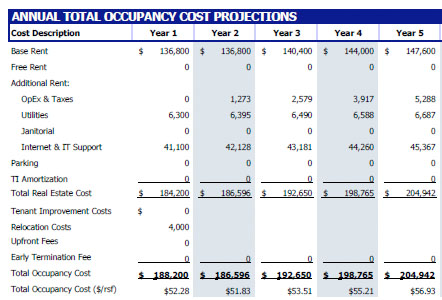

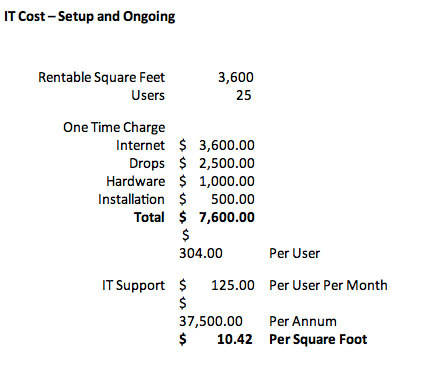

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.