If your company signed an office lease during the Great Recession chances are your rents are looking pretty, pretty, pretty good.

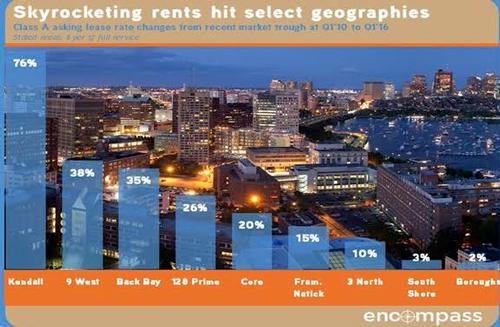

Office space in Boston is growing increasingly more expensive. So much so current asking rents are at some of the highest they have ever been. The top floors of the Prudential building are asking $90 per rentable square foot…$90!

Boston Office Market Trends

The urban leasing team at Boston Realty Advisors wanted to know how much has changed in the last five years across all of Greater Boston’s major neighborhoods: East Cambridge, Seaport, Financial District, Back Bay, North Station. They included image break downs of each market on asking rental rates and vacancy rates for the top tier buildings (Class A) and the middle market buildings (Class B). The facts are astounding!

If your company’s lease is expiring in the next 12-24 months chances are the second fixed expense on your balance sheet next to payroll will be increasing if you wish to renew. Now is the time to engage your real estate team on how the current market dynamics will impact the company’s short and long terms plans for office space, the company’s bottom line, and how your company uses its current space. Knowing the options, risks, and opportunities in the current real estate climate is the best hedge against a rising market. Its starts with being proactive. Time can be your best leverage but quickly your worst enemy when it is running out.

Robert LeClair is Managing Director and Partner at Boston Realty Advisors having handled hundreds of lease transactions for clients in Greater Boston for over the last 10yrs.

Click here to download the full PDF: Boston Office Market Trends 2010-2015