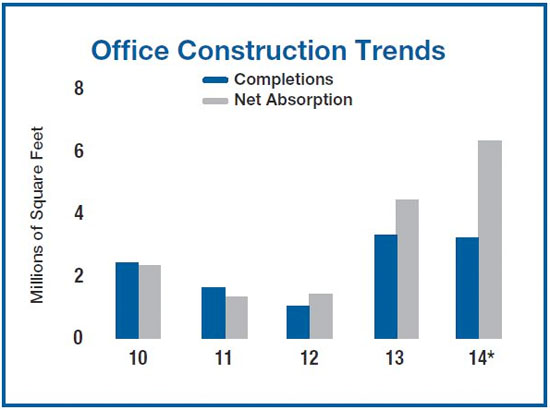

The Boston office and retail market is expected to continue its upward march.

According to an editorial on MultiHousingNews.com, “developers completed approximately 4.2 million square feet of office space over the last 12 months as compared to merely 1.4 million square feet in the previous year. Around 5.2 million square feet currently under construction in the metro area is expected to come online throughout 2016. According to Marcus & Millichap, approximately 3.2 million square feet of office space is set for completion by the end of 2014—a 1 percent increase from 2013—with new inventory being heavily concentrated in the Boston/Suffolk County and Route 128 North submarkets.”

For a detailed indicator of the Boston office market direction, jump over to the MultiHousingNews website.

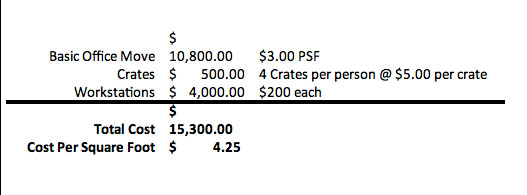

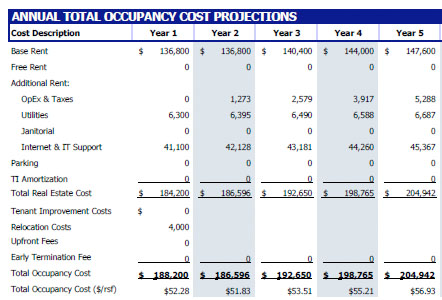

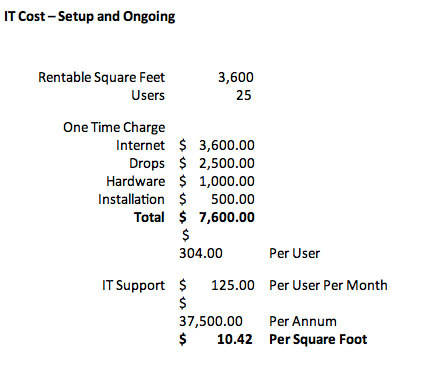

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.