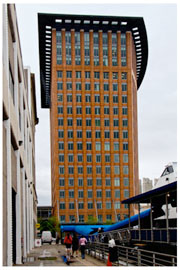

Ink Block is on the move and the transformation of the Herald’s HQ will commence later this year.

The Boston Business Journal reports on the construction, noting the Ink Block is “designed to re-imagine the former Herald site in the South End at Harrison Avenue and Traveler Street, Ink Block will feature 475 apartments in five buildings and 85,000 square feet of retail space, including a flagship 50,000-square-foot Whole Foods Market, which will be the chain’s largest location in Boston and the first-ever full-size grocery store in the South End.”

For additional information on the former Boston Herald HQ, jump over to the BBJ’s full article.