Downtown Boston is the largest concentration North of New York City and is in the midst of strong rent growth across the Class A and B segments. Today’s technology and creative services companies are looking for easy access to public transportation combined with an open floor plan.

From Banker & Tradesman:

For the third straight year in 2014, the Greater Boston office market recorded more than 2 million square feet of positive absorption, in a steady expansion that boosted occupancy rates at properties ranging from suburban office parks to converted warehouses and downtown high-rises.

“There’s more office product than ever and it’s getting filled in a much more dense way than ever before,” said Brendan Carroll, vice president of research for Avison Young. “If you’re wondering why the T seems more packed, or why you can’t get a cab to take you across the (Fort Point) Channel, that seems to be the reason.”

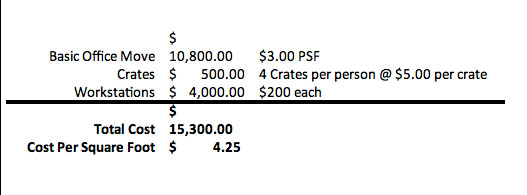

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.

What would it cost to move your company from Downtown Crossing in the Financial District to the Seaport? Let’s assume you are in 3,600 rentable square feet and moving into something similar.