Harbor Corporate Center in Boston Seaport District

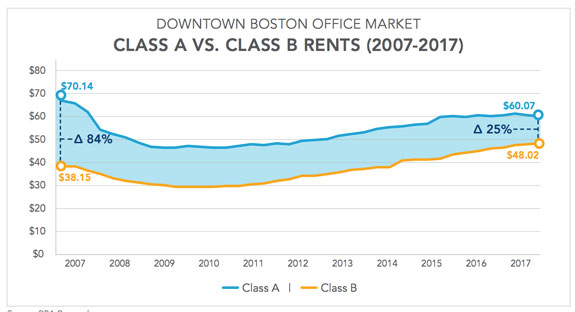

It is true, office rents are going to continue to rise with no expected tenant relief until after 2017. This is primarily due to the limited amount of speculative new construction coming online. Developers have chosen the residential dollars to chase over the office dollar and very few office developers are willing to go in the ground on spec.

B&T notes, “Dropping a 30-percent rent-bomb on the Boston market is going to have a big impact, even if it is spread over three years…For starters, if they stick, higher rents will make winners out of all those new office towers on the drawing boards right now for downtown Boston. Building a new tower in Boston these days can easily be a billion-dollar proposition and someone has to foot the bill for it…So the rent spike is music to the ears of all those ambitious developers, who will need to push rents towards $80, if not $100, a square foot for their top suites to keep their lenders on board and meet their projections.”

You can read the full article on Banker&Tradesman, here. Alternatively, click to browse currently available office space in Boston, ahead of the expected 10% growth next year.