The recovery is well underway which is evident by the downtown vacancy rate dropping below 10 percent.

The recovery is well underway which is evident by the downtown vacancy rate dropping below 10 percent.

According to a Banker & Tradesman article, referencing a Jones Lang LaSalle (JLL) report on commercial leasing, “Boston is officially in growth mode and has exceeded its pre-recession jobs peak…high-tech and life sciences continue to grow, at 9.8 percent and 5.9 percent year-over-year, respectively.”

Additional details on the commercial market recovery are available on the Banker & Tradesman website.

Related commercial real estate listings

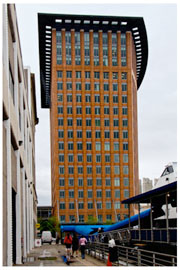

Boston Office Space for lease