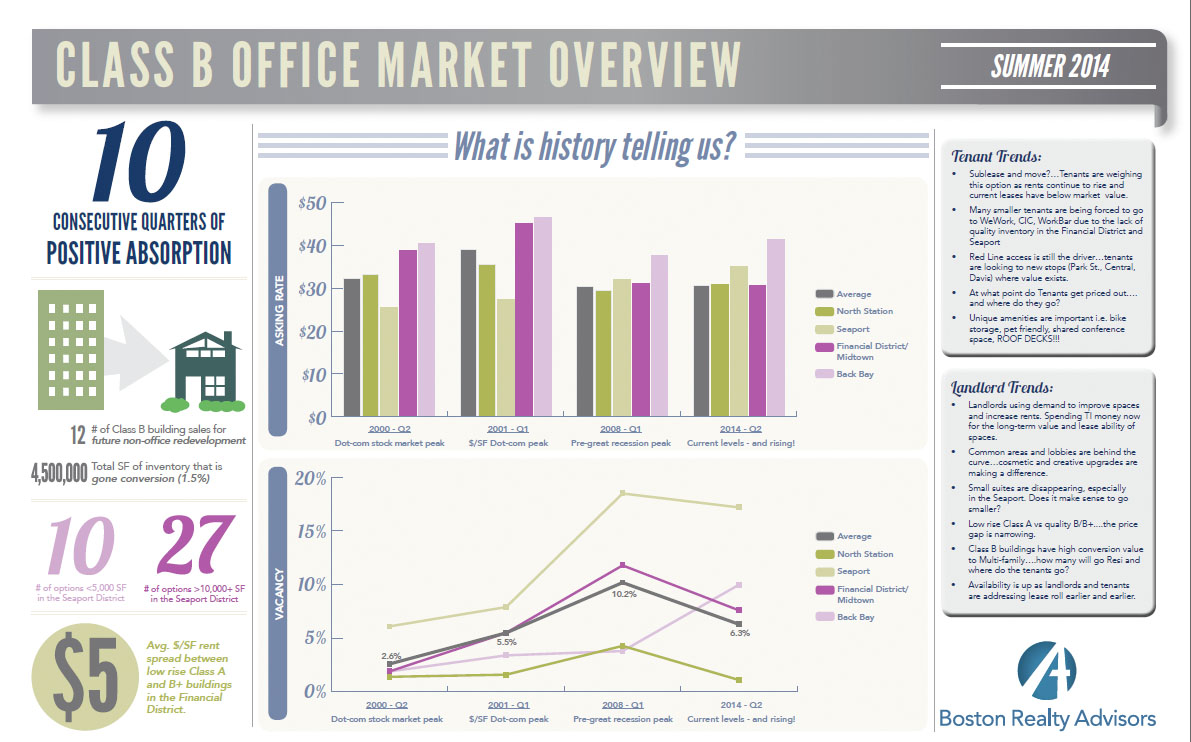

Boston is 3rd in office rent growth for 2014 behind Singapore and San Francisco. The factors that drive Boston are the innovative economy and the extensive university presence. The YE Market Report (link below) goes through the Downtown Class B office market fundamentals.

“According to Banker&Tradesman, Boston ranked first globally with a 34.6-percent increase in capital value growth. Foreign investors drove up prices of the Boston region’s commercial real estate, with investors such as Toronto-based Oxford Properties Group and Norges Bank Investment Management buying trophy office buildings in Boston and Cambridge. The index is designed to identify which cities are changing the fastest by combining real estate data with socioeconomic factors.”

You can download a pdf of the report here: http://www.bostonrealestates.com/reports/year-end-2014/Downtown/YE-MarketReport-Downtown-lo.pdf