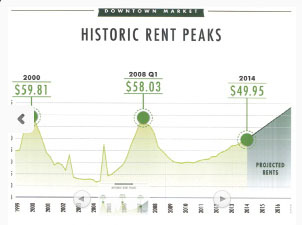

Rents are on the move, upward and don’t see any signs of letting up. Class B product in the Downtown Crossing (DTX) area of the city have seen increases from the high $20’s a couple of years ago to the low $40’s. Future predictions expect the 2016 levels to surpass the 2000 and 2007 markets peaks.

Nerej.com notes, “the city of Boston office market is absolutely exploding. 1.72 million s/f of office space was absorbed in 2014, 35% more than in 2013, and 50% more than in 2012. What statistics do not show is that Boston as a city has $110 billion in total assessed value for all its properties; $4 billion in new construction breaking ground, 4,500 current job openings and 44 tech IPO’s in the pipeline. 50% of total absorption in 2014 was urban migration from the suburbs. As of the start of 2015, there are 222,000 s/f of tenants in the market for downtown space alone.

You can read more about the Boston Office Market explosion on Nerej.com.