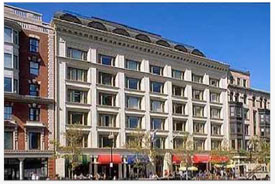

Urban Meritage closes on another piece of Newbury Street real estate by adding 50,000 rentable square feet.

From The Real Reporter:

Bringing its CRE holdings secured here to 11 properties in just 21 months, the partnership of Urban Meritage and Novaya Ventures (UMNV) has taken a giant step forth in purchasing the hulking six-story 126 Newbury St. from its longtime New York owner in an eye-popping $54.2 million deal consummated earlier today. Rudin Management’s trade brings UMNV’s portfolio of assets focused along the famed shopping boulevard to nearly $150 million, blowing past the $100 million level in one fell swoop and giving the firm three prime buildings between Berkeley and Exeter Streets, the latest on the third block up from the Boston Public Garden and next to the second block where UMNV began its platform via the $10.0 million.