This is terrific news and should be implemented immediately. Public access to our natural beauty is imperative to the City’s continued growth in the years to come. Not too far back, the suppression of the Central Artery bridged many areas of our city and created the Greenway.

From Bisnow:

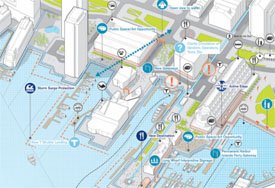

“The City’s new proposal to spend $20M to upgrade 40 acres along the waterfront from the North End to Fort Point with open space, cultural attractions, and entertainment (fingers crossed for Ferris wheel) will elevate the rapidly changing district, BRA deputy director for waterfront planning Richard McGuiness tells Bisnow. The aim: upgrade the border of “our greatest natural resource: Boston Harbor.”

The complete Bisnow article is available on its website, here