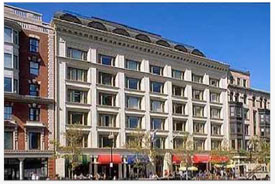

Boston Properties is bullish on Boston with projects underway or proposed from Back Bay, Financial District and North Station.

· 888 Boylston has seen the crane arrive and has announced is major tenant Natixis Global Asset Management

· 100 Federal Street is looking to add more retail on the Congress Street side of the project

From the Boston Herald:

“In 2015, we estimate we could move approximately $1 billion in pre-development projects into our active development pipeline,” CEO Owen Thomas said. “Before launching any of these projects, we need to complete the entitlement and planning process and, in most cases, some level of pre-leasing.”