By Jason S. Weissman | Commercial Observer | December 10, 2020

At the flip of a switch, COVID-19 created a paradigm shift in real estate investment. Pension fund darlings turned ice cold overnight. Risk profiles turned on their heads. The four, classic real estate investment strategies of Core, Core-Plus, Value-Add and Opportunistic are no longer definitive. COVID-19 also provided the collective built environment with a valuable stress test, revealing new risk variables.

These risk variables include two major components of uncertainty: migration trends and how people will work in the future. In order for real estate investors to stay competitive during the current climate and deliver compelling value, they will have to make educated bets on an unpredictable future. The good news: centralized information and greater visibility into data is on our side.

The pandemic upended the impending population growth of major North American cities, leaving the future of urbanization a guessing game. Chris Nebenzahl, editorial director at Yardi Matrix, recently explained that many large metros underwent five years of outward migration in just six months. Additionally, according to a recent economic report by Upwork, between 14 and 23 million Americans plan to move from urban to suburban and tertiary markets.

To appreciate how urbanization will rebound, multiple questions need to be answered. How will business travel change? Are new shopping trends here to stay? Will people work remotely in perpetuity? There is no magic remedy, and these uncertain times make all questions more challenging to answer.

Even during the most demanding of times, we must not abandon the tried-and-true methods of evaluating real estate investment opportunities. Evolving commercial occupancy rates, consumer trends and new work routines will continue to be the primary drivers of real estate investment models.

The most resilient assets throughout the pandemic have been real estate occupied by credit tenants in the net-leased retail and industrial categories, along with the single-family sector (SFR space) and multifamily assets within secondary cities and suburbia. According to the National Association of Real Estate Investment Trusts, industrial REITs are up 18.5 percent year to date. Data centers are up 37.86 percent, and single-family REITs are up 4.1 percent. Conversely (and not surprisingly), office REITs are down 27 percent, while lodging and resorts are down an astounding 45.58 percent.

How will the real estate investment ecosystem realign? In all times, and specifically during uncertain ones, financiers should profoundly evaluate risk. Investors should be extremely conservative on appreciation and the risks of cash flow with fluctuating tenancy. “Attention should be paid as much to what can go wrong (risk) as to what can go right (return),” Seth Klarman noted in his book, “Margin of Safety.”

As the real estate investment community treads forward, it will have to deep dive into the supply and demand of the asset types under consideration, and then attempt to make a future assumption on that supply and demand. Look back 15 to 20 years to review the historical rents, expenses and occupancy rates. This valuable information will enable investors to make assumptions based on market statistics and performance. The thoughtful collection of fundamental data can be developed into a strategic investment strategy to weather all cycles.

Despite these uncertain times, investors will make bets on core market central business districts, specifically the hospitality and retail properties located within them. These investment types have high risk, but also embody the potential for high returns. However, it is much too early to make predictions about either asset class or primary CBDs. In the immediate short term, cities are going to lose inhabitants. Taking the long view, though, I deeply believe in the attraction of big cities and the benefits of their walkability, convenience, lifestyle, and their culture that fosters innovation.

In an uncertain investment climate, invest in what you understand the best. Seek sticky cash flow and make sure leverage is low. Market timing is paramount, but staying power is just as important. To paraphrase Warren Buffett, “Don’t buy a stock unless you’re willing to hold it for 10 years.” Even good investments with a sound investment thesis have risk. Risks are diminished if you have time on your side.

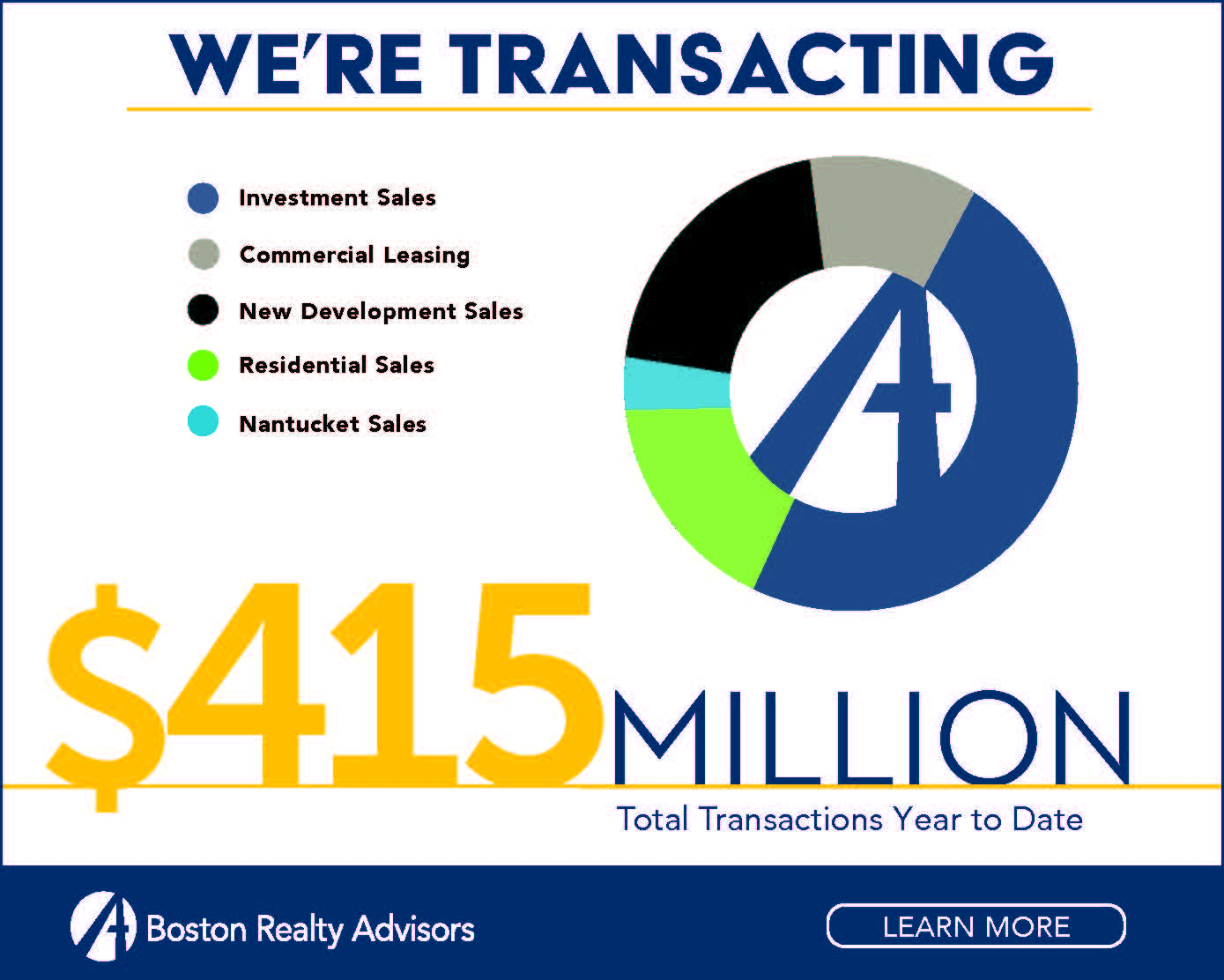

Jason S. Weissman is founder and CEO of Boston Realty Advisors, the largest full-service independent real estate brokerage and advisory firm in Massachusetts.