Back Bay COVID Lease Incentive – Free Rent Until July 2021

Learn more HERE.

CRES Stats Report | Week Ending November 20

By Joe Clements | The Real Reporter | November 18, 2020

CAMBRIDGE — Clover is never mentioned, but marketing materials from exclusive sales agent Boston Realty Advisors are singing the praises for Crimson Court in predicting the “generational” low-rise apartments steps from Harvard Square will be a 1960’s-era smash appealing to a vast audience of admirers.

“Crimson Court is an irreplaceable asset by every measurable standard,” BRA’s review proclaims of apartments held by the same clan who constructed the 60 low-rise units in 1965 and has “meticulously maintained” the holdings for all 55 of their leasehold seasons, BRA notes in a pitch suggesting the offering is much more than a one-hit wonder. That is literally true considering 375 Harvard St. is comprised of two buildings where two-thirds of the rentals are two-bedroom layouts mixed in with 10 studios and 10 one-bedrooms.

“We anticipate there will be a lot of interest in this,” BRA founding principal Jason S. Weissman tells Real Reporter in acknowledging the assignment launched Tuesday afternoon. By some accounts, Crimson Court could approach $425,000 per unit, which if achieved would land in the mid-$20 million range. Declining to discuss those unofficial estimates, Weissman says the level will be set through the bidding process but maintains institutional players will “definitely” be in the running along with private capital, setting up potential for a spirited battle among the suitors fueled by Crimson Court’s “Class-A location” between Harvard University and the Massachusetts Institute of Technology.

Besides being bookended by those two world-class schools attending on both the undergraduate and graduate levels, the rental constituency comes from young professionals drawn to a lineup of major employers in Cambridge’s Kendall Square and across the river in downtown Boston, both of which are accessible by the “Brain Train,” aka the MBTA Red Line subway which is a five-minute stroll from 375 Harvard St. For those attuned to money, money and other business perks, BRA has assembled a lineup showing dozens of Tier One Cambridge employers spanning the alphabet from Amazon, Biogen, Facebook, Google and Ironwood to Moderna, Novartis, Sanofi, Takeda and Yahoo.

There are also reams of direct public transit options spiriting tenants as far afield as Braintree, Waltham and booming Watertown, although BRA stresses Crimson Court has “a wealth of amenities” within walking distance from coffee houses, restaurants and takeout venues between Broadway and Massachusetts Avenue plus a panoply of entertainment and retail choices featuring global merchants and local boutiques. “Whether taking a stroll to a nearby park or enjoying the Charles River, the options are truly endless,” the BRA brochure further explains.

A leading urban multifamily operation with several record-breaking Cambridge deals under BRA’s belt over the past decade, Weissman expresses confidence Crimson Court will draw investor interest from around the corner and around the globe, and that instinct is already bearing fruit with BRA lining up tours of the asset almost immediately upon the exclusive assignment’s release Tuesday afternoon.

“We are super-excited about this one,” Weissman says of Crimson Court, adding BRA has a band of agents and specialists ready to assist bidders on demographics, rental metrics and other market trends. Managing Director and partner Nicholas M. Herz has debt and structured finance options available for interested investors, while Associate Directors Kevin Benzinger and Andrew Herald will dispatch street-level knowledge with support from Associates Daniel J. Dewing and Ryan McDonald plus Analyst David Harte.

Given the legacy nature of Crimson Court, Weissman says he is confident plenty of investors will pursue the asset and not only due to its steady performance over the past half-century and the “unprecedented opportunity” to buy such an infill location.

One tantalizing aspect, for example, are the 56 off-street parking spots located on the L-shaped site perched in a neighborhood where parking is severely restricted and regulated. That is one benefit of the asset’s longevity, according to BRA who is also promoting a value-add aspect available from upgrading the apartments and moving rents towards modern market averages.

“There are a lot of things to love about this property,” concurs Weissman who even sees a silver lining in the Covid-19 situation that appears in some analysis to indicate renters—and by extension, investors—have a perceived preference for more modest rental options size-wise compared to the high-rise residential towers that have been cropping up in metropolitan Boston this past decade. “The timing is right for this,” observes Weissman.

Crimson Court Apartments is held under the entity Audubon Road Associates CCSPE. The buildings are sited on a 32,325 sf parcel acquired by the family ownership in July 1963 just prior to their construction.

Congratulations, Kyruus, on your recent office lease in the Financial District.

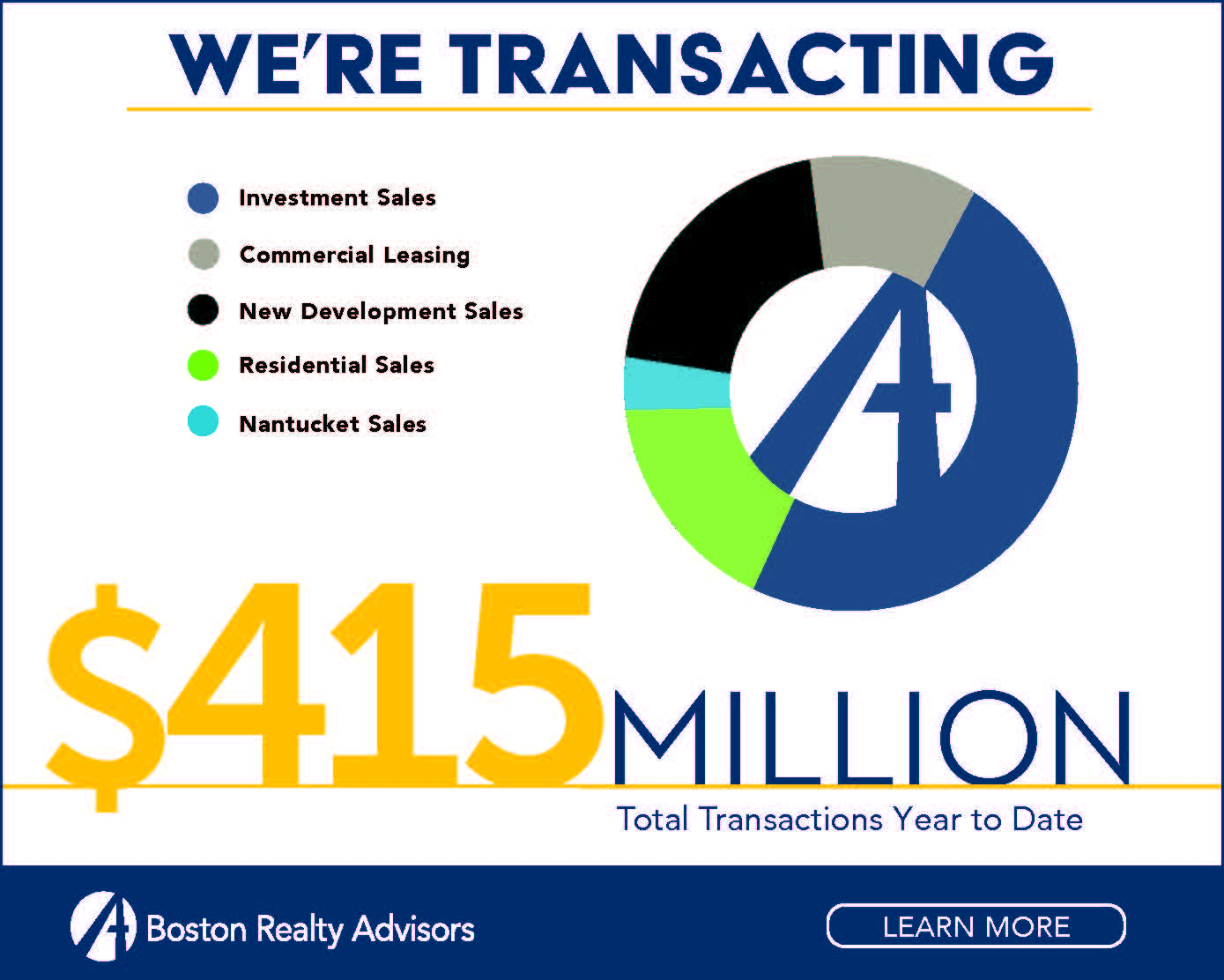

BRA IS TRANSACTING IN A LIVE-WORK-PLAY ENVIRONMENT.

SELLING HOMES. LEASING COMMERCIAL SPACE. BROKERING INVESTMENT SALES.

Learn more HERE.

Congratulations, Tenant’s Development Trust, on your recent office lease in South End.

CRES Stats Report | Week Ending November 13

Negative absorption continues with 24 spaces hitting the market as available in the subject area in the last 7 days, equating to 176,000 SF.

18 spaces (over 1,000 SF) came off the market equating to 196,000 SF which appears to be sublease space “going direct” or being withdrawn by sublessors. More study is needed.

Checking back in on the Financial District: this is a 36,000,000 SF office area, with a direct availability of 10.1%, resulting in a 13.1% (9.5mm SF) total availability rate.

The availability rate in Boston spiked to an all-time recent high of 15,800,000 SF.